This is a very IMPORTANT announcement for all Ontario auto insurance policyholders. As of June 1, 2016, there will be major changes to your auto insurance policy coverage.

Auto Insurance Coverage Changes

In an effort to make auto insurance premiums more affordable the Ontario government has introduced changes to the auto insurance system. These changes apply to auto insurance policies issued or renewed on or after June 1, 2016.

The changes will provide you with more options when it comes to purchasing your auto insurance, which ultimately gives you more control over the price you pay. Just as shopping at a grocery store, the more items you put into your cart the higher the cost.

The New ‘Standard’ Policy

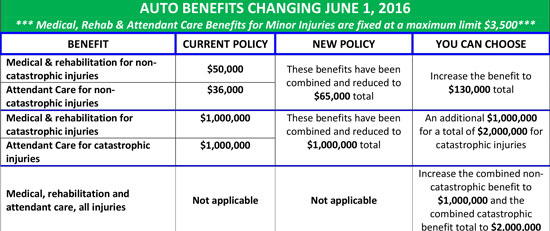

Most of the changes were made to the Statutory Accident Benefits you receive if you are injured in an accident. Since some benefits were reduced you may want to review what has changed, as the new ‘standard’ policies will not offer the same benefits you previously had access to.

In contrast, the options available to add to your policy have improved; allowing for customized coverage that meets your needs. For example, if you have dependents that rely on you for care or financially you are able to extend your Caregiver Benefit and/or add the Dependent Care Benefit to your coverage.

There are a variety of optional coverages for you to consider.

Helpful Resources

Other Changes

- MINOR ACCIDENT - If you are involved in a minor accident after June 1, 2016 (no injuries, damages less than $2,000 – to be paid by at fault driver) your insurer can no longer increase your premium. This is limited to one minor accident every three years.

NON EARNER BENEFIT – The six-month waiting period for those who are not working was reduced to four weeks.

What you NEED to know

The reason it is essential you are aware of the changes is because if you do not contact your insurance broker (before June 1, 2016) then your policy will be renewed with the new lower standard benefits, which may not suit your lifestyle needs.

We will continue to bring you updates on the Ontario auto insurance benefit changes, as this discussion continues to develop. Make sure you have the insurance coverage you desire, contact your broker to discuss. If you have any questions please do not hesitate to contact your Youngs Insurance broker today.

SIMILAR POSTS

>> The Least Expensive Cars to Insure in Ontario>> The 10 Most Stolen Vehicles in Ontario